Exit strategies for intraday trading

You're in a winning trade, and now you need to figure out how you will exit the trade profitably. How you will exit a trade should be planned before you enter.

Below we outline a number of different ways to exit a profitable trade; no matter which you choose to use, the goal is to strike a balance between letting profits run and not getting so greedy that you fail to realize the market is reversing on you. Let a profit run long enough and it will eventually turn back into a loss.

Traders need a plan that allows them to let their profits run beyond what they typically lose on a losing trade, but also realize that the market will not move in their direction forever.

Here are several methods to help you do it. The trailing stop is probably the most well know profit extraction technique. In simplest terms, as the price moves in your favor, an exit order moves along with it, trailing the price by some set amount. It only moves higher though, never back down.

A trailing stop works the same way for a short position, except it will always trail the lowest price. A trailing stop can be implemented in many ways. In an uptrend, a stop may be moved up to below recent lows. Thus, if the price creates a lower swing low you exit your trade. But if the price keeps making higher lows, then you keep moving the trailing stop up to lock in more and more profit.

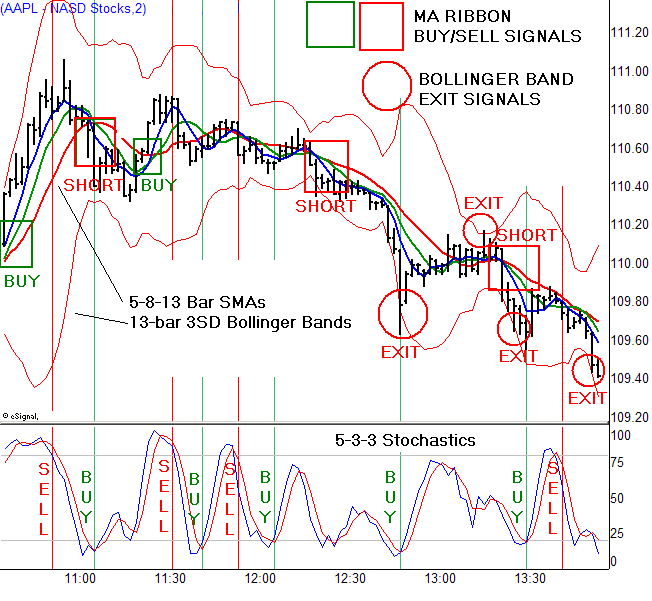

Please note that all chart examples were created using Freestockcharts. Certain indicators have a trailing stop built right in. For example, apply the Parabolic SAR for an idea on where to place your trailing stop. With each new price bar the indicator value will change, locking in a bit more profit. Other indicators that can be used for this function are Volatility Stops, Chandelier Exit, and even Bollinger Bands and Keltner Channels. The trailing stop works best in strong trends, but if the trend is choppy it will often result in poorly timed exits.

In Figure 1 and 2, the price did continue higher after the trade was closed, but it is impossible to squeeze every penny out of a trade. A trailing stop allows the market to run, but gets you out when there is a potential reversal underway.

Establishing a price target is a great way to establish your potential reward relative to risk.

Day Trading | Average True Range | Trading System | Software

This is advantageous to all traders, but especially those who lack time to constantly monitor their trades. Commonly, price targets are used for trading chart patterns, with the target based on the size of the pattern.

The rule of thumb with any chart pattern is that you can add for an upside breakout the height of the pattern to breakout price to establish an approximate price targets.

If the breakout is to the downside, subtract the height of the pattern from the breakout price. If the price has been struggling to get higher than a certain point resistance you may opt to place a price target just below the resistance region.

If you have a short position, you may opt to place a price target just above support. Once the price showed a tendency to stall at the support and resistance areas, profit targets could have been placed near the resistance zone for long trades, and near the support zone for short trades.

The downside of using a fixed price target is that there is no leeway.

Learn This Swing Trading Exit Strategy

The price could come just shy of the target, and reverse. To avoid this you may wish to monitor the price as it approaches your target; if it almost reaches the target and then starts to move against you, exit the trade.

Assume a stock is trending higher—making higher swing highs and higher swing lows—and so you enter a long position. If the price makes a lower swing high and lower swing low the trend could be over, so you would exit the trade. If you use indicators, you may get into a trade because the indicator gave you positive signals. Figure 5 shows a scenario during a downtrend. The chart shows two potential profitable exits, although there are many others that could be used.

The downside to this method is that it requires some analysis, and can be very subjective. It just tells you the reason you were in the trade is now gone. There is no best way to exit a profitable trade. For some trades, one method will work well, but will fair worse on other trades. The key is to decide on a method and stick to it, potentially using some of these methods in conjunction with one another. Ten Commandments of Futures Trading. Are you looking for stocks that are showing signs of bottoming out?

Intraday Trading Tactics | Combining Price Action Trading With MACD

Are you looking for over-extended stocks to sell? Active traders can use this list to find potential candidates and screen for the most attractive Enter your e-mail address to subscribe. Low Volatility ETFs invest in securities with low volatility characteristics.

These funds tend to have relatively stable share prices, and higher than average yields. Investors who suspect that the stock market may be about to decline can take action to reduce the Thank you for selecting your broker.

Please help us personalize your experience. Your personalized experience is almost ready. Join other Individual Investors receiving FREE personalized market updates and research. Join other Institutional Investors receiving FREE personalized market updates and research. Join other Financial Advisors receiving FREE personalized market updates and research. Check your email and confirm your subscription to complete your personalized experience. Thank you for your submission, we hope you enjoy your experience.

Free Newsletter News Newsletter Articles Trader University Trading Securities Trading Platforms Trading Indicators Trading Strategies Lighter Side of TraderHQ Forex Trading TraderHQ. Home News Newsletter Articles Trader University Trading Securities Trading Platforms Trading Indicators Trading Strategies Lighter Side of TraderHQ Forex Trading TraderHQ.

Trading Strategies 3 Ways To Exit A Profitable Trade. Cory Mitchell Apr 03, When the downward trendline breaks you can exit the trade. When the MACD moves into positive territory above zero you could exit the trade, assuming you were short because the MACD was bearish prior. When the price makes a significant slightly higher low, and then begins to makes smaller higher highs and higher lows you could exit because there is evidence to suggest the trend is no longer down.

Get Email Updates Subscribe to receive FREE updates, insights and more, straight to your inbox. News Most Oversold Stocks This Week: June 20 Sneha Shah Jun 20, News Most Overbought Stocks This Week: June 19 Sneha Shah Jun 19, News 25 Best and Worst Performing Stocks This Week: June 15 Sneha Shah Jun 15, Tools Periodic Table of Asset Bubbles.

Education A Trader's Guide to Tops and Bottoms Beginner's Guide to Sector Rotation Top 21 Trading Rules for Beginners: A Visual Guide 50 Blogs Every Serious Trader Should Read What Is Day Trading? Legal Privacy Policy Terms of Use Follow TraderHQ.

Enter your e-mail address to subscribe Powerful trading insights sent every weekday morning Gain instant access to actionable trading tips Strategically improve your trading strategy.

We Respect Your Privacy. Is your portfolio protected for what the markets will bring this fall? Creating a properly diversified portfolio can be a difficult proposition, especially when ETF Investing Low Volatility ETF List Low Volatility ETFs invest in securities with low volatility characteristics.

ETF Investing 10 ETFs for Risk Reduction in Your Portfolio Bob Ciura.