Bid ask spread fx options

As more and more traders have learned of the multitude of potential benefits available to them via the use of options, the trading volume in options has proliferated over the years. This trend has also been driven by the advent of electronic trading and data dissemination. Some traders use options to speculate on price direction, others to hedge existing or anticipated positions and others still to craft unique positions that offer benefits not routinely available to the trader of just the underlying stock, index or futures contract for example, the ability to make money if the underlying security remains relatively unchanged.

Regardless of their objective, one of the keys to success is to pick the right option, or combination of options, needed to create a position with the desired risk-to-reward tradeoff s.

As such, today's savvy option trader is typically looking at a more sophisticated set of data when it comes to options than the traders of decades past.

The Old Days of Option Price Reporting In "the old days" some newspapers used to list rows and rows of nearly indecipherable option price data deep within its financial section such as that displayed in Figure 1.

Options Basics: How To Read An Options Table

Investor's Business Daily and the Wall Street Journal still include a partial listing of option data for many of the more active optionable stocks. The old newspaper listings included mostly just the basics — a "P" or a "C" to indicate if the option a call or a put, the strike price, the last trade price for the option, and in some cases, volume and open interest figures.

And while this was all well and good, many of today's option traders have a greater understanding of the variables that drive option trades. Learn more in Using the Greeks to Understand Options.

As a result, more and more traders are finding option data via on-line sources. While each source has its own format for presenting the data, the key variables generally include those listed in Figure 2.

The option listing shown in Figure 2 is from Optionetics Platinum software. The variables listed are the ones most looked at by today's better educated option trader. The data provided in Figure 2 provides the following information: Column 1 — OpSym: Column 2 — Bid pts: The "bid" price is the latest price offered by a market maker to buy a particular option. Column 3 — Ask pts: The "ask" price is the latest price offered by a market maker to sell a particular option.

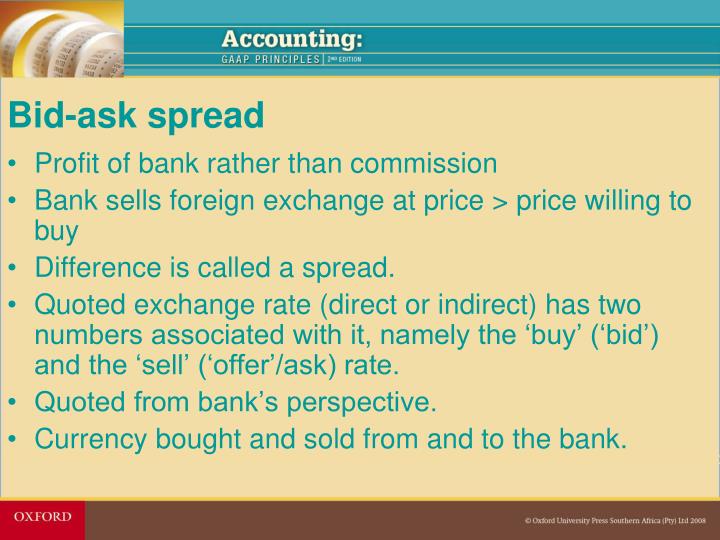

Buying at the bid and selling at the ask is how market makers make their living. It is imperative for an option trader to consider the difference between the bid and ask price when considering any option trade. A wide spread can be problematic for any trader, especially a short-term trader.

This column displays the amount of time premium built into the price of each option in this example there are two prices, one based on the bid price and the other on the ask price.

This is important to note because all options lose all of their time premium by the time of option expiration. So this value reflects the entire amount of time premium presently built into the price of the option. This value is calculated by an option pricing model such as the Black-Scholes model , and represents the level of expected future volatility based on the current price of the option and other known option pricing variables including the amount of time until expiration, the difference between the strike price and the actual stock price and a risk-free interest rate.

If you have access to the historical range of IV values for the security in question you can determine if the current level of extrinsic value is presently on the high end good for writing options or low end good for buying options. Delta is a Greek value derived from an option pricing model and which represents the "stock equivalent position" for an option. The delta for a call option can range from 0 to and for a put option from 0 to If the stock goes up one full point, the option will gain roughly one half a point.

The further an option is in-the-money, the more the position acts like a stock position. In other words, as delta approaches the option trades more and more like the underlying stock i. For more check out Using the Greeks to Understand Options. Gamma is another Greek value derived from an option pricing model. Gamma tells you how many deltas the option will gain or lose if the underlying stock rises by one full point.

In addition, if the stock rises in price today by one full point this option will gain 5. Vega is a Greek value that indicates the amount by which the price of the option would be expected to rise or fall based solely on a one point increase in implied volatility. So looking once again at the March call, if implied volatility rose one point — from This indicates why it is preferable to buy options when implied volatility is low you pay relatively less time premium and a subsequent rise in IV will inflate the price of the option and to write options when implied volatility is high as more premium is available and a subsequent decline in IV will deflate the price of the option.

As was noted in the extrinsic value column, all options lose all time premium by expiration. In addition, " time decay " as it is known, accelerates as expiration draws closer. Theta is the Greek value that indicates how much value an option will lose with the passage of one day's time. Column 10 — Volume: This simply tells you how many contracts of a particular option were traded during the latest session.

Column 11 — Open Interest: This value indicates the total number of contracts of a particular option that have been opened but have not yet been offset. Column 12 — Strike: The " strike price " for the option in question.

This is the price that the buyer of that option can purchase the underlying security at if he chooses to exercise his option.

It is also the price at which the writer of the option must sell the underlying security if the option is exercised against him. A table for the respective put options would similar, with two primary differences: With puts, it is just the opposite.

As the strike prices go higher, put options become either less-out-of-the-money or more in-the-money and thus accrete more intrinsic value. Thus with puts the option prices are greater as the strike prices rise. Option trading and the sophistication level of the average option trader have come a long way since option trading began decades ago. Today's option quote screen reflects these advances.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. How To Read An Options Table By Adam Hayes, CFA Share. How Options Work Options Basics: Types Of Options Options Basics: How To Read An Options Table Options Basics: Options Spreads Options Basics: Options Risks Options Basics: Option data from a newspaper Investor's Business Daily and the Wall Street Journal still include a partial listing of option data for many of the more active optionable stocks.

March call options for IBM The data provided in Figure 2 provides the following information: Call options are more expensive the lower the strike price, put options are more expensive the higher the strike price. With calls, the lower strike prices have the highest option prices, with option prices declining at each higher strike level. This is because each successive strike price is either less in-the-money or more out-of-the-money , thus each contains less "intrinsic value" than the option at the next lower strike price.

For call options, the delta values are positive and are higher at lower strike price. For put options, the delta values are negative and are higher at higher strike price. The negative values for put options derive from the fact that they represent a stock equivalent position. Buying a put option is similar to entering a short position in a stock, hence the negative delta value.

A thorough understanding of risk is essential in options trading. So is knowing the factors that affect option price. Find out how you can use the "Greeks" to guide your options trading strategy and help balance your portfolio.

These risk-exposure measurements help traders detect how sensitive a specific trade is to price, volatility and time decay. Investing in Google GOOG generally requires you to pay the price of the share multiplied by the number of shares bought. An alternative using lesser capital involves using options. Learn more about stock options, including some basic terminology and the source of profits. Futures contracts are available for all sorts of financial products, from equity indexes to precious metals.

Trading options based on futures means buying call or put options based on the direction Options can be an excellent addition to a portfolio. Find out how to get started. Trading options is not easy and should only be done under the guidance of a professional.

Simple Explanation of an Options Trading Bid-Ask Spread

You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.