Put option strikes

December 2, by Brian Mallia. It is not a complex concept per se, but it is a concept you want to have a full understanding of before you begin trading.

Remember that when you buy or sell an option, you are entering into a contract with another person and agreeing on a transaction involving three things:. Because strike price is such a vital piece of the way an option is priced, it is important to understand more than just the definition of the term.

It is also important to understand how a strike price relates to call options and put options. In this post, we will not only look at those things We will also reveal the 4 most important considerations when choosing a strike price. Simply stated, a strike price also referred to as exercise price is the fixed price at which an option contract can be exercised.

To the seller, strike price is important at trade entry because it has a direct impact on how much credit they receive from selling the option. Once a trade has been placed, the direction the underlying moves in relation to the strike price determines the profitability of the trade.

Option — Wikipédia

Seems like an easy enough concept, no? A call option is an agreement where a buyer has the right to buy shares of stock from a seller before the option expires at a set price. What price is that exactly? The purchaser of the call can choose to but is never obligated exercise the option at the strike price at any time, and the seller must sell shares to the buyer if the buyer chooses to exercise the option contract.

If the call option expires out of the money the strike price is above the stock price , than the seller gets to keep the credit received and the buyer loses the debit paid for the trade.

If the call option expires in the money the strike price is below the stock price , the call buyer can exercise the option for shares of stock, or sell the option back for a profit. If the buyer exercises the option, the seller must sell shares of the stock at the given strike price.

As the call buyer, I am looking for the option to expire in the money the stock price is above the strike price so that I can exercise the option. As the seller of the call , you are looking for the stock price to remain out of the money the stock price is below the strike price. A put option is just the opposite of a call option.

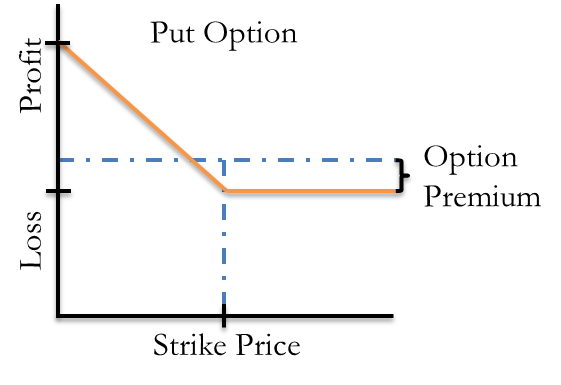

With a put option, the buyer has the right to sell shares of stock at the strike price before expiration. The purchaser of the put option has the right but not the obligation to exercise the option at the strike price anytime before expiration and the seller must purchase shares of the stock if the buyer chooses to exercise the option. If the put expires out of the money the strike price is below the stock price , then the seller gets to hold onto the credit they received and the buyer loses the debit paid to place the trade.

If the put option expires in the money the strike price is above the stock price , the purchaser of the put can exercise the option for shares of stock, or sell it back for a profit. In the above scenario as the purchaser of the put option , I am hoping that the put option expires in the money when the stock price is below the strike price.

Since you are selling me the option, you're hoping that the option expires out of the money when the stock price is above the strike price in order to keep the credit you collected when we entered into the trade.

As you can see, the strike price is one of the major inputs of how much profit or loss can occur from a trade. One comment we get from time to time is "Ok, so I understand what a strike price is, but tell me how to choose a strike price. You should now better understand what strike price is and how it relates to profit and loss for both call and put options.

Also, you now know what factors to keep in mind when determining the strike price of your next trade! Watch Step Up to Options to learn more about different types of option trades. Still have questions regarding strike price? Leave it in the comments and we will be sure to answer it!

Options strategies - Wikipedia

In part 3 of our liquidity series we go over strike price volume. The stock might be liquid, but is the strike price of the option you are trading? This week she is talking about IV Rank, see what questions the support desk gets the most! Beginner intermediate Blog Sign Up Login. Remember that when you buy or sell an option, you are entering into a contract with another person and agreeing on a transaction involving three things: A timeframe called an expiration date A price for the option for the buyer it is called a debit, for the seller this is called a credit A strike price 0 0 1 44 dough inc 2 1 Strike Price Definition 0 0 1 dough inc 5 1 Call Options Strike Price 0 0 1 28 dough inc 1 1 Strike Price Example - Call Option.

Put Options Strike Price A put option is just the opposite of a call option. Put Option Strike Price Example 0 0 1 81 dough inc 3 1 Strike Price Example - Put Option. How To Choose A Strike Price Choosing a strike price is not too difficult when you keep these four things in mind: The 'Illiquid' teardrop symbol in the dough application.

If you choose a strike price with low option volume therefore illiquid , you may not be able to get filled on the trade or worse, you may not be able exit the trade before expiration if the underlying is illiquid.

In the Money vs. Width of the Strikes - when trading any strategy containing a spread credit spread, debit spread, iron condor, etc.

Put Option Definition, Put Options Examples, What are Puts?

A five point wide iron condor will hold significantly more risk than a one point wide iron condor, but the probability of profit and credit received will be much higher. This can be found prominently on the trade page within the dough trading application. Conclusion You should now better understand what strike price is and how it relates to profit and loss for both call and put options.

Sign up for dough today, it's free! Strike Price Volume Liquidity Part 3. Jul 2, beginner iv rank , implied volatility , high implied volatility , education , Tracy Algeo Tracy Algeo Comment. Stock Volume Liquidity Part 2.