Effect of stock buyback of share price

June 26, By Trey Henninger Leave a Comment. In my last post I discussed dividends which are one method which company management can use to return value to shareholders.

The other main method is what is known as stock buybacks. This results in a few immediate effects.

Reduction in the number of shares outstanding, reduction in the cash held by the company, change in the value of the company, and most of the time a change in the per share value of the company. This will also reduce the cash held by the company and reduce the value of the company. However, they have increased their ownership in the company. This increase will mean that any future earnings from the company are due to you at a larger percentage than they were before.

Assuming both dividends and buybacks are taxed in the same way, there should be no preference between the two. The difference is that dividends are paid to all shareholders without any requirement of selling their shares, while share buybacks use cash to pay fewer shareholders that have to sell their shares to get the cash.

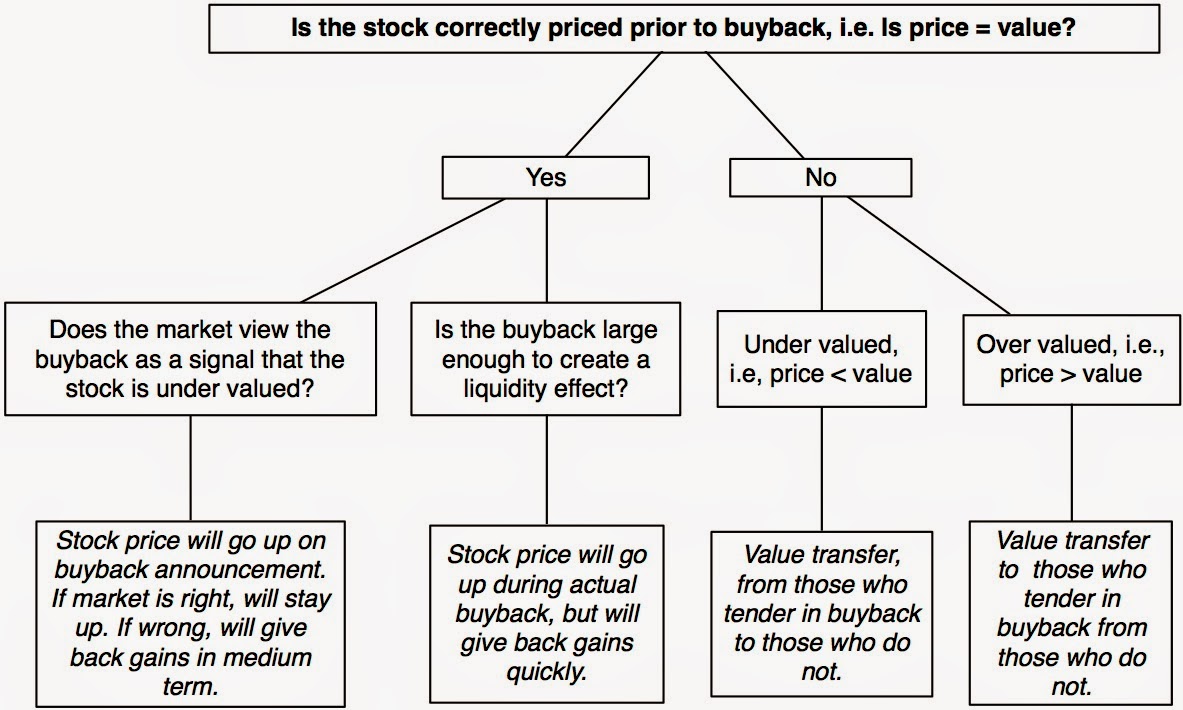

The reason is that the market price and the book value were the same. If the market price was different than the book value, then the per share value of the company would change as well.

If the market price of the company is above the book value, then the per share value of the company will go down. However, if the market price of the company is below book value, then the per share value of the company will increase.

This is a very important point to remember. Be aware of this next time you see a company buyback announced.

Stock buybacks are just one way of returning value to shareholders. The other most common method is dividend payments. When a company repurchases their own shares, the number of shares outstanding decreases.

The percentage ownership for continuing shareholders will increase, but the overall value of the company will go down by the amount of cash spent to repurchase the shares. Unlike with dividends, it is important to consider the market price vs the book value when choosing to perform a stock buyback.

What do you think of stock buybacks? Would you want companies that you own to perform them? Leave your thoughts in the comments below.

Indigovision Group Share Price | IND Stock News | Interactive Investor

If this article was helpful to you, consider sharing with your friends on Facebook. The link below will make it easy for you to share. In the United States, dividends are taxed while share buybacks are not. That is why, at the time of this writing, many companies are relying more and more on share buybacks to return cash to shareholders instead of dividends. Subscribe to our Weekly Newsletter! Signup and receive a sneak peak of next week's content.

I will never give away, trade or sell your email address.

You can unsubscribe at any time. General Concepts Tagged With: I am an engineer, private investor, and business owner. I want to empower you, and to help you unlock the potential future earnings which would go to waste if you ignore investing any longer. I taught myself how to invest and now I hope to help teach you how to invest.

Does a Stock Buyback Affect the Price? | Finance - Zacks

However, I have spent thousands of hours reading, learning and teaching myself how to invest. Subscribe To Our Newsletter Never miss a post! Recent Posts Ultimate Guide: Major Topics k bond market bonds book value brokerage account compound interest corporate tax coupon rate discount rate dividends diyinvesting diy investing emergency fund fear financial goals financial independence fundamental analysis government regulation guide Index Funds inflation infrastructure interest intrinsic value investing investments investor type market price money Mutual Funds net worth passive investor purchasing power rate of return savings savings rate shareholders stock market stocks taxes tax shelter time value investing Vicki Robin Your Money or Your Life.

Disclaimer All investments entail risks. The value of shares and investments and the income derived from them can go down and up.

Investors may not get back the amount they invested. Past performance is not a guide for future performance.

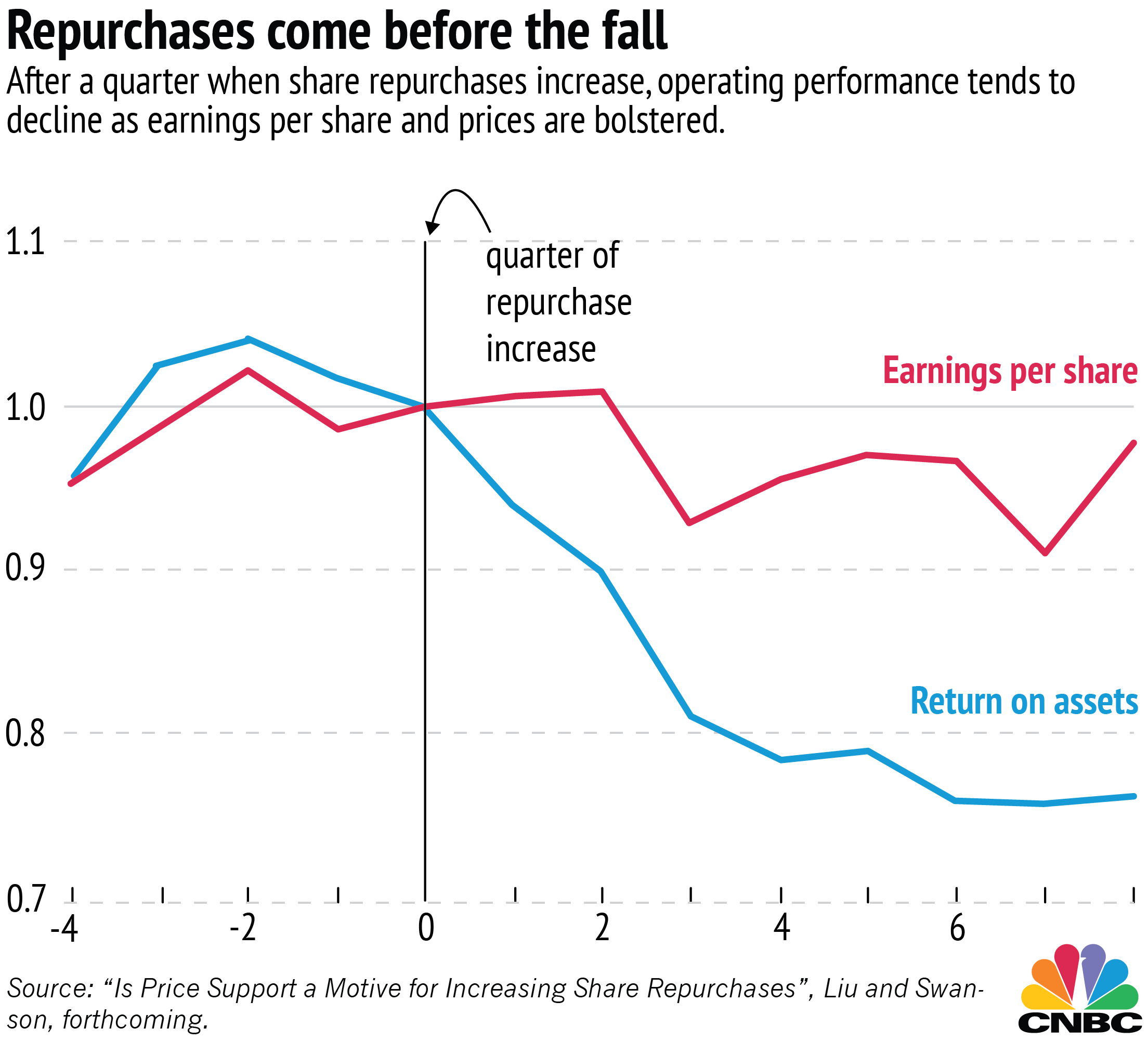

Share buybacks: What they are and why they may not work - Business Insider

All information, tools, and resources presented on this site are for informational and educational use only. Please refer to the Terms of Service for more information. Pin It on Pinterest.